The value of dynamic, clinically driven models

by Auxilius on Oct 4, 2022 6:00:00 AM

Clinical trials are complex, multi-faceted, and are, at their core, about data. However, despite the abundance of data on the clinical side, biotechs often struggle to convert their clinical data into effective financial forecasting that reflects the current state and trajectory of their study. While much of this may be due to a translational gap between finance and ClinOps teams, there’s also a glaring gap in toolsets.

As Fierce Biotech has reported, “clinical trials are generating more data than ever and researchers need systems capable of recording, storing and managing the additional information.” Yet IBM finds that “most companies manage the clinical trials process using spreadsheets, which leads to error and difficulty in arriving at a consolidated forecast plan with sufficient detail to improve forecast accuracy.”

Connecting cost to key drivers

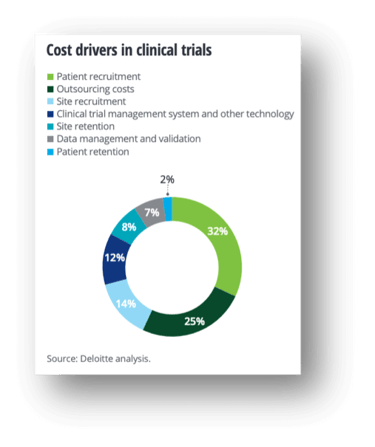

It’s common knowledge that clinical trials are expensive to conduct: The average clinical R&D lifecycle takes nine years and carries a $1.3 billion price tag from origination to FDA approval. According to Sertkaya, A., et al., “across all study phases and excluding estimated site overhead costs and costs for sponsors to monitor the study, the top three cost drivers of clinical trial expenditures were clinical procedure costs (15%–22% of total), administrative staff costs (11%–29% of total), and site monitoring costs (9%–14% of total).” Deloitte finds a similar breakdown (see below). What’s surprising is how opaque these expenses can be to those funding the trials themselves. Source: Deloitte

Source: Deloitte

From a sponsor’s perspective, these costs can also be very unpredictable and volatile, especially if outsourced via a CRO or to third parties: the data may be at arms-length, lagging, or inaccurate. In terms of accuracy, initially budgeted amounts may vary significantly from actual contracted amounts with sites or investigators, leading to potential cost overruns or diminished runway. If the sponsor’s financial forecasting doesn’t incorporate real-time updates the sites, a lot of money is being spent without clear and timely visibility.

Adding clinical insight to financial intelligence

As biotech finance leaders embark upon a new study, clinical drivers should be a vital part of an accurate and comprehensive forecasting process. The majority of costs within a trial are driven by one of the following: patients, sites, study timeline, and other clinical events. Without the use of these elements in your financial models, sponsors generally resort to straightlining significant portions of the cost across the trial. If you don’t have a clear and consistent view of what has happened in the trial, it's nearly impossible to recalibrate your forecast and anticipate change.

Leveraging tools to optimize forecasting

Deloitte finds that for “driver-based forecasting you need an integrated platform where you can see the consensus forecast across the company, measure performance against drivers, and run a distributive process. It's possible to set something up through a spreadsheet, though an integrated tool can better execute this.” As the biggest portion of P&L for many biotechs, clinical R&D is paramount; yet many biotechs find themselves trying to adapt industry-agnostic FP&A tools to the unique clinical trials use case. Simply put, if your tools don’t automate clinical inputs, you are forecasting at a disadvantage without extensive manual work to keep your models aligned.

Bringing the drivers and the technology together

As noted by PwC, “the future of R&D Finance will establish a rich historical data source that will provide real-time visibility into the prevailing trends across the portfolio and more accurately project costs by understanding the disease state, patient type, procedures (as per the protocol), and conditional visits that materially drive cost.” With integrated and clinically informed data at their disposal through a tool like Auxilius, finance teams are in the driver’s seat. The right tools and technology ensure your strategic and tactical financial decisions are trued up to each study’s true north.

References

- https://www.fiercebiotech.com/cro/clinical-trial-data-surge-driving-demand-management-tech

- https://www.pwc.com/us/en/industries/pharma-life-sciences/pdf/pwc-the-evolving-role-of-finance-in-pharma-r-and-d.pdf

- https://www2.deloitte.com/us/en/pages/operations/articles/driver-based-planning.html

- Sertkaya, A., Wong, H.-H., Jessup, A., & Beleche, T. (2016). Key cost drivers of pharmaceutical clinical trials in the United States. Clinical Trials, 13(2), 117–126. https://doi.org/10.1177/1740774515625964

- ftp://public.dhe.ibm.com/software/data/sw-library/cognos/pdfs/blueprints/bp_bvg_life_sciences_clinical_trials.pdf

- https://www.bpmpartners.com/wp-content/uploads/2018/10/FPA-Guide-Driver-Based-ModelingvF.pdf

Share this

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- August 2024 (6)

- June 2024 (2)

- December 2023 (1)

- October 2023 (1)

- September 2023 (4)

- April 2023 (1)

- February 2023 (2)

- January 2023 (2)

- December 2022 (1)

- November 2022 (2)

- October 2022 (3)

- September 2022 (4)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (3)

- April 2022 (3)

- March 2022 (1)

- August 2021 (1)