Regulatory Run Down – The Big Deal in Clinical Trial Financial Reporting and Controls

by Auxilius on Sep 18, 2023 7:53:12 AM

The SEC has recently applied more pressure to the Audit profession in calling for increased entity-level risk evaluation - effectively broadening the scope of risk for which auditors must attest to.

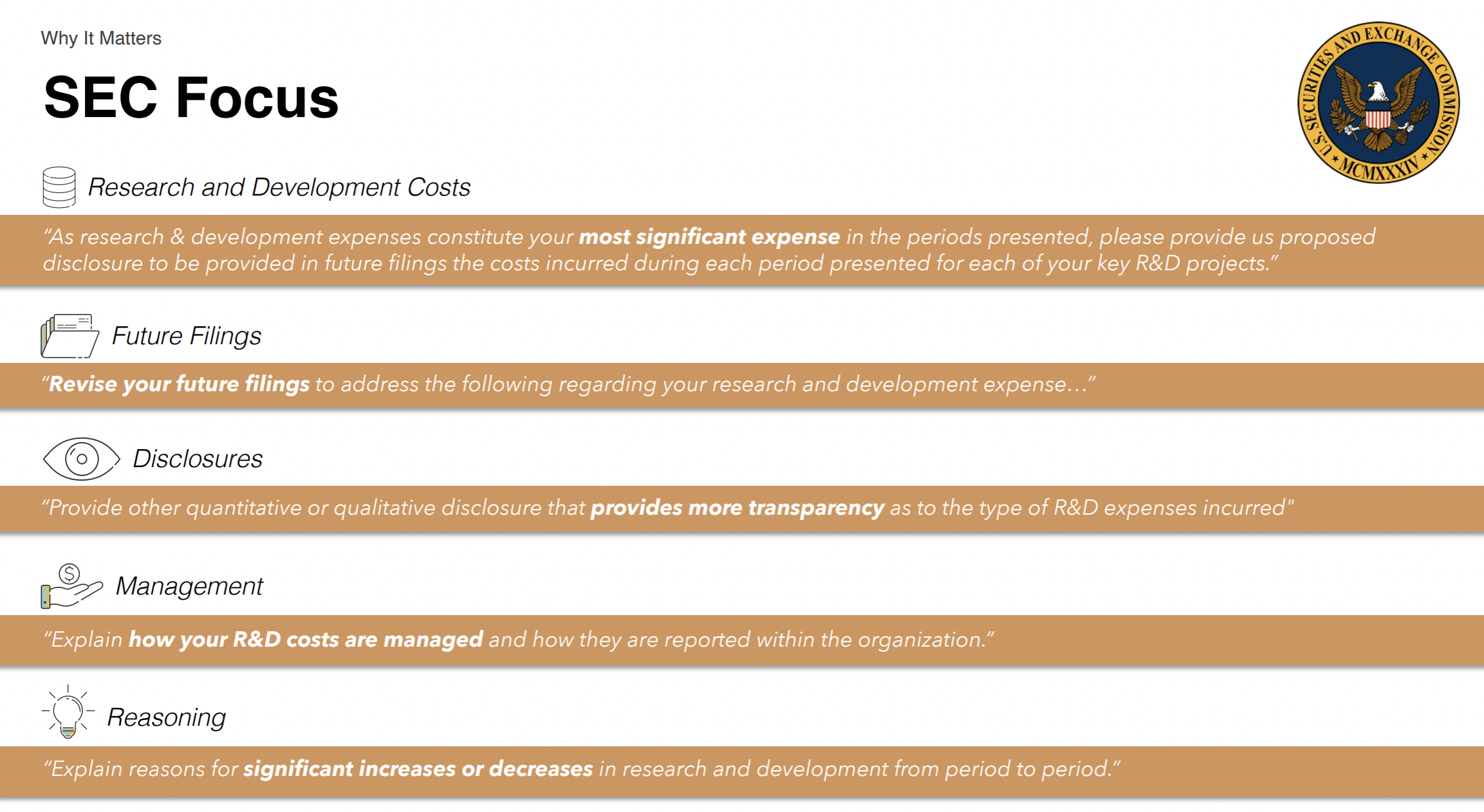

Accounting for R&D remains an area of high scrutiny for auditors and regulators. Expenses for clinical trials continues to be a major theme of recent SEC comments and requests, frequently calling for more balanced disclosure, additional elaboration on the nature of R&D expenses incurred, disaggregation based on program and substantiation for fluctuations.

Source: Auxilius & Crowe LLP, July 2023

Clinical R&D accruals are often times cited as a Critical Audit Matter and similarly the SEC is calling for companies to increase their disclosure around this highly material line item. Substantiation around period over period variances, detailed explanation on clinical trial cost drivers and an expectation for R&D spend accrual accuracy are a staple of compliant financial reporting for today’s biotech organization.

Among middle market and pre-IPO life science companies, SEC comments related to R&D made up 8.2% (*Moss Adams) of post-IPO SEC correspondence in recent years, up from all prior years. And 65% of companies recently polled have not yet established a materiality threshold for R&D and clinical trial costs.

The disaggregation of R&D expenses and enhanced disclosure of clinical trial costs is standard for SEC reporting. Comment letter trends signal a need for more disaggregated information related to R&D expenses.

SEC Reporting Takeaways:

- Clinical trials are often a Critical Audit Matter

- Public filers must track R&D programs separately and distinctly from an accounting and financial reporting standpoint

- Fluctuations, period over period, often flag SEC interest and need substantiation

- The establishment and documentation of a materiality threshold is important

R&D accruals are inherently complex, manually laborious, financially significant and risk laden due to the highly outsourced nature of these activities. Typically, they require a high-level of management judgement. For life science companies, large and small, the materiality of a mistake can expose a company to regulatory risk and financial reporting volatility – Internal Control over Financial Reporting must be robust and risk-based.

If you are an Emerging Growth Company, and therefore not currently beholden to CAMs, consider that auditors can choose to early adopt or to apply voluntarily. Approximately 40% (*Cooley) of EGC companies surveyed applied CAMs voluntarily.

Internal Control Takeaways:

- ICFR around clinical trial accruals are critical due to their financial materiality and complexity

- Clinical trial accruals and the organizational processes to support the accrual need robust and solid documentation to support forecast methodology, related deviations and substantiation for the booked accrual

- EGC companies ... don’t assume that the above doesn’t impact you and plan ahead for future organizational change

Get in touch with our team to learn more ways to gain control and increase compliance around clinical trial financial management.

Share this

- November 2024 (1)

- October 2024 (2)

- September 2024 (1)

- August 2024 (6)

- June 2024 (2)

- December 2023 (1)

- October 2023 (1)

- September 2023 (4)

- April 2023 (1)

- February 2023 (2)

- January 2023 (2)

- December 2022 (1)

- November 2022 (2)

- October 2022 (3)

- September 2022 (4)

- August 2022 (2)

- July 2022 (2)

- June 2022 (2)

- May 2022 (3)

- April 2022 (3)

- March 2022 (1)

- August 2021 (1)